Monetization trends in 2022

In recent years, the approach to monetization and the attitude towards it has been changing. Previously different genres used multiple monetization mechanics, but lately, more and more mechanics are moving from one game genre to another. We have already written how Battle Passes expanded into Match-3 games, and how Piggy Banks spread from gambling games to almost all genres. And there is a multitude of further examples of mechanics migrating from one genre to another.

In 2022, all of this will have a special meaning. You’ll be thinking about monetization not just in terms of “changing direction” and spending 10-20% of team resources. Monetization will take up more resources, and live ops may become the main focus of many projects.

Why is this our future? And for some — their present?

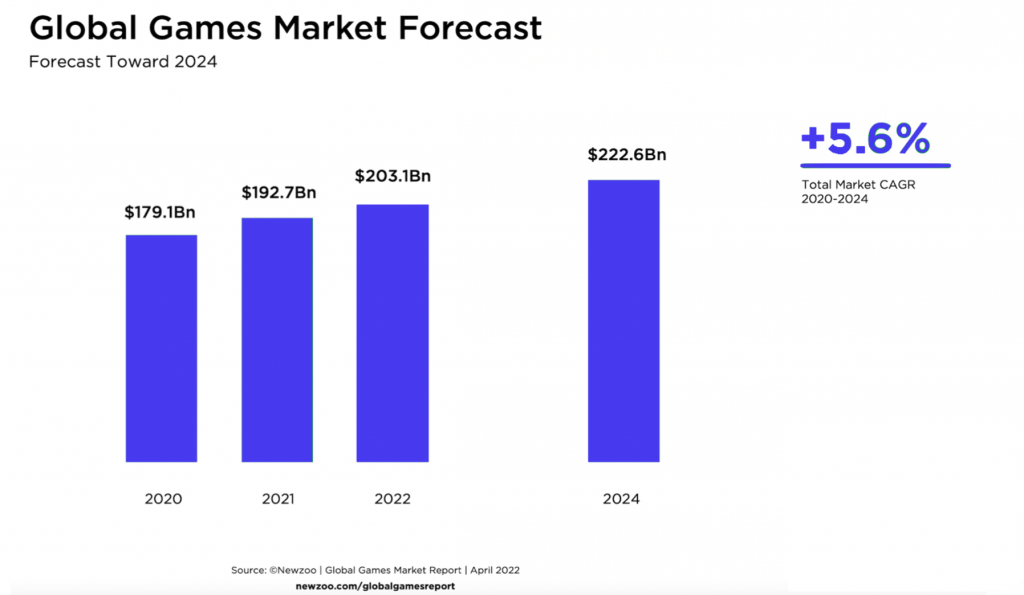

Back in April, Newzoo provided estimates of game revenue toward 2024

*Our revenues encompass consumer spending on games: physical and digital full-game copies, in-game spending, and subscription services like Xbox Game Pass. Mobile revenues exclude advertising. Our estimates exclude taxes, secondhand trade or secondary markets, advertising revenues earned in and around games, console and peripheral hardware, B2B services, and the online gambling and betting industry.

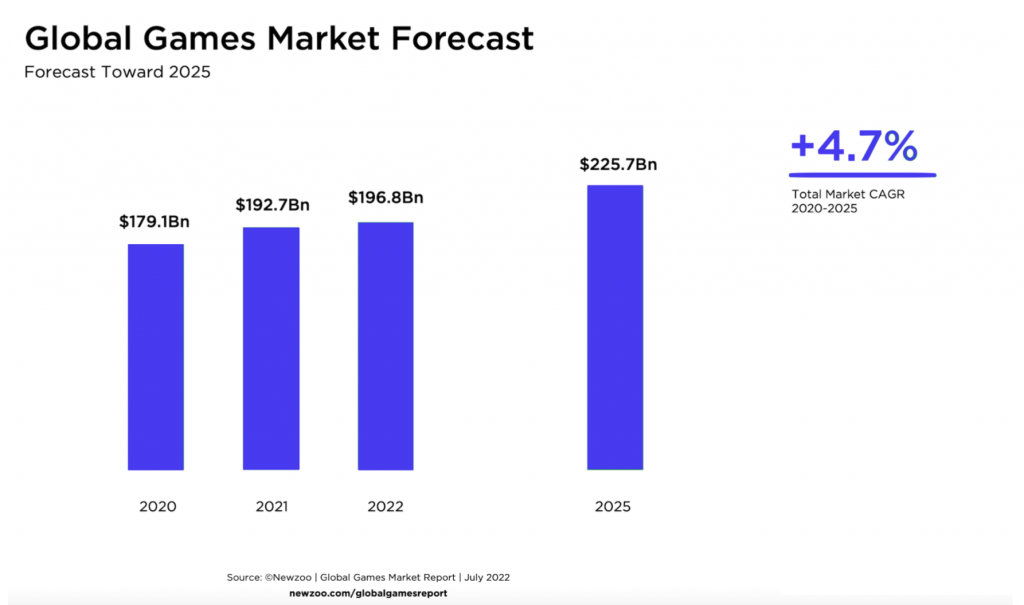

In July, the situation looked quite different

*Our revenues encompass consumer spending on games: physical and digital full-game copies, in-game spending, and subscription services like Xbox Game Pass. Mobile revenues exclude advertising. Our estimates exclude taxes, secondhand trade or secondary markets, advertising revenues earned in and around games, console and peripheral hardware, B2B services, and the online gambling and betting industry.

Looking at the $222Bn figure, the situation seems to have changed, but the upward trend remains. However, as of right now, it will take another year to reach the indicators predicted for 2022.

What’s important is the situation in 2022. In contrast with previous years, we are experiencing something close to stagnation. Not only due to a decline in gaming revenue but also to mass layoffs and an increase in the number of unemployed people. From 2020 to 2021, the industry recorded a growth of 7.2%.

As for the development of the industry from 2021 to 2022, previously the forecast told of a growth of 5.3%, but the updated data speaks of a 2.1% increase.

The forecast for 2025 can be called optimistic. But if before major gaming companies could rely on the industry growing, the number of players and revenue increasing, now it is no longer possible.

Therefore, the value of monetization and live-ops as a tool to boost profits from a project’s current audience is increasing dramatically. And it is already changing the market.

| The number of vacancies for monetization and live-ops managers increased tenfold in the first half of 2022. The numbers were gathered through a mail subscription to job listings on major job hunting portals in various regions. |

The increased interest in monetization and live-ops will inevitably lead to the emergence of new monetization mechanics and more experimentation — the introduction of new sales types, new visualizations for special offers, checkout placement tests/time limits. It will also lead to changes in the way Battle Passes, piggy banks, subscriptions, and everything else will work and how long they will last. We will see the appearance of distinctive mechanics in genres where they have almost never been seen before.

Next, we are preparing a series of articles in which we will try to review the flagships of different genres for similarities and differences in monetization mechanics. We will try to guess which mechanics will get further development in the near future!

Follow our newsletters so you will not miss our new articles 😉